Matrack Fuel Card

The Matrack Fuel Card combines fuel savings with compliance tracking for fleet operators. It integrates fuel transactions with ELD data for better fuel management and regulatory compliance.

Key Features of Matrack ELD Fuel Card

- Saves up to 50 cents per gallon by routing to the cheapest fuel stations.

- Links fuel purchases with driver logs and GPS data.

- Sets spending limits and monitors purchases in real-time.

- Assigns driver tasks while optimizing fuel-efficient routes.

- Tracks vehicle locations, fuel stops, and driver behavior.

Limitations of Matrack ELD Fuel Card

- Requires Matrack’s ELD system for full functionality.

AtoB Fuel Card

AtoB Fuel Card provides high diesel discounts, making it a great choice for trucking companies. It works at any Mastercard-accepting station and includes real-time tracking and security features.

Key Features

- Up to $1.85 per gallon savings on diesel.

- 5 cents per gallon savings on regular gas.

- Works at any gas station that accepts Mastercard.

- Real-time fuel tracking and security features.

- Offers cashback on select services like maintenance and repairs.

Limitations

- Requires app usage for maximum discounts.

- Monthly fees apply.

- Balance must be paid in full each month.

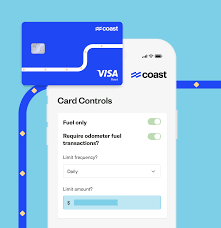

Coast Fleet Card

Coast Fleet Card is designed for small businesses with fuel and non-fuel needs. It offers up to 10¢ per gallon rebates and 1% cashback on non-fuel purchases.

Key Features

- Accepted anywhere Visa is accepted.

- Up to 10 cents per gallon rebate at partner stations.

- 1% cashback on non-fuel purchases.

- Automatic receipt tracking for better expense management.

- No setup fees

Limitations

- Monthly fee of $4 per active card.

- $35 fee for returned or late payments.

- Balance must be paid in full each month.

WEX Flexcard

WEX Fleet FlexCard is widely accepted and provides fraud protection with detailed tracking. It’s best for businesses needing nationwide coverage.

Key Features

- Works at 45,000+ fueling stations.

- 3 cents per gallon discount for the first 6 months.

- No account setup fees.

- Detailed transaction tracking and fraud protection.

Limitation

- High late payment fees.

- No rewards on non-fuel purchases.

- Discounts depend on fuel volume purchased.

Fuelman Mixed Fleet Card

Fuelman Mixed Fleet Card offers some of the highest discounts, making it ideal for businesses managing both gas and diesel fleets.

Key Features

- Up to 12 cents per gallon discount.

- Accepted at over 40,000 stations nationwide.

- No setup fees.

- Customizable dashboards for fleet tracking.

- Security features to prevent fraud and misuse.

Limitation

- Monthly fees range from $39 to $99.

- Charges $3 for using non-network gas stations.

- Must pay balance in full each month.

ExxonMobil Business Card

ExxonMobil Business Card is best for companies fueling at Exxon and Mobil stations, providing up to 6¢ per gallon discounts and mileage reports.

Key Features

- Up to 6 cents per gallon discount.

- Works at over 12,000 ExxonMobil locations.

- Real-time fuel tracking and alerts.

- Mileage and miles-per-gallon reports.

Limitation

- Only works at Exxon and Mobil stations.

- Additional fees for expanded network usage.

- Requires a high fuel purchase volume for maximum discounts.

Shell Small Business Card

Shell Small Business Card is great for companies that frequently fuel at Shell and Jiffy Lube locations. It includes spending controls and no monthly card fees.

Key Features

- Up to 6 cents per gallon discount.

- Accepted at Shell stations and select Jiffy Lube locations.

- No monthly card fees.

- Spending controls for each driver.

Limitation

- Requires purchasing over 10,000 gallons per month for top rebates.

- Limited to Shell stations.

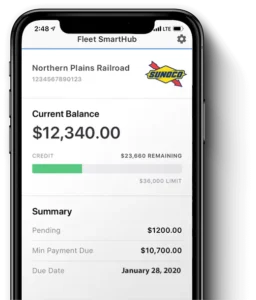

Sunoco Fleet Card

Sunoco Fleet Card offers fee-free fuel savings, making it a strong choice for small businesses looking to cut costs.

Key Features

- No annual, setup, or monthly fees.

- Discounts of up to 6 cents per gallon.

- Works at 95% of U.S. fuel stations.

- Detailed reporting and fraud prevention.

Limitations

Discounts apply only at Sunoco stations.

Comdata Fuel Card

The Comdata Fuel Card is tailored for trucking companies and large fleets, offering bulk fuel discounts and route optimization tools.

Key Features

Best for trucking companies.

Advanced fraud protection and security.

Works at over 8,000 truck stops nationwide.

Provides detailed fleet spending insights.

Limitations

Strict eligibility criteria.

High penalties for late payments.

U.S. Bank Voyager Fleet Card

U.S. Bank Voyager Fleet Card provides wide acceptance with over 320,000 locations but lacks significant fuel discounts.

Key Features

- Accepted at 320,000+ locations nationwide.

- Advanced fraud protection.

- No setup fees.

Limitations

No major fuel discounts.

BP Business Solutions Fuel Card

The BP Business Solutions Card offers high-volume rebates, making it a good option for businesses with significant fuel consumption.

Key Features

- High-volume fuel rebates.

- Real-time transaction tracking.

Limitations

- Requires a minimum monthly fuel purchase for rebates.

Benefits of Fuel Cards

Fuel Discounts

Fuel cards provide discounts ranging from 2 to 12 cents per gallon. Some cards offer higher discounts when fuel is purchased in bulk or at partner stations.

Real-Time Expense Tracking

Every fuel purchase is logged instantly, allowing businesses to monitor fuel spending per vehicle, driver, and location.

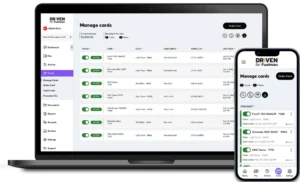

Spending Limits and Purchase Controls

- Limits can be set on fuel quantity, transaction amount, and fuel type.

- Businesses can restrict non-fuel purchases, preventing misuse.

Fraud Prevention

- Transactions are limited to fuel stations, reducing unauthorized spending.

- Some cards offer PIN authentication to prevent fraudulent transactions.

Route Optimization

- Some cards integrate with GPS tracking to help businesses plan fuel-efficient routes.

- Reducing unnecessary mileage lowers fuel consumption and costs.

Tax Benefits

- Businesses can track and deduct fuel expenses easily.

- Some fuel cards automatically generate IFTA (International Fuel Tax Agreement) reports for tax filing.

How Fuel Cards Improve Efficiency

Fuel Usage Tracking

Fuel cards record each transaction, providing detailed insights into fuel spending. Businesses can monitor:

- Total fuel consumption per vehicle and driver.

- Fuel prices across different locations.

- Unusual spending patterns that indicate inefficiencies or fraud.

Spending Controls & Fraud Prevention

- Limit the number of fuel purchases per day or week.

- Restrict non-fuel purchases like snacks, beverages, and other store items.

- Set a maximum spending cap per transaction.

Route Optimization

- Reducing unnecessary detours and traffic congestion lowers fuel consumption.

- Some fuel cards integrate with GPS tracking systems to help businesses plan cost-effective routes.

Driver Behavior Monitoring

- Fuel cards can detect excessive idling, harsh braking, and rapid acceleration, which increase fuel consumption.

- Businesses can use this data to train drivers on fuel-efficient habits.

Maintenance Alerts

- Some fuel cards track vehicle mileage and fuel efficiency, providing maintenance alerts.

- Preventive maintenance ensures vehicles operate at peak efficiency, reducing fuel waste.

Conclusion

Fuel cards help businesses cut costs, track expenses, and improve efficiency. The right card depends on fuel volume, station preference, and fleet size. Cards like Fuelman and AtoB offer the highest discounts, while WEX and U.S. Bank Voyager provide wide acceptance.

Choosing the best fuel card ensures lower expenses, better control, and optimized fuel management.

James Johnson is a former truck driver who now works as a writer, specializing in the trucking industry. With over 15 years of experience on the road, James has a unique perspective on the challenges and opportunities faced by truck drivers and the trucking industry as a whole. His writing focuses on issues such as safety, regulation, and the latest industry trends. His work has been featured in several trucking publications and he has received recognition for his contributions to the industry. In his free time, James still enjoys being around trucks and often attends truck shows and other industry events.